Depreciation of laptop calculator

First we want to calculate the annual. ATO Depreciation Rates 2021.

Excel Salary Sheet With Formula By Learning Center In Urdu Hinidi Learning Centers Excel Learning

The tool includes updates to reflect tax depreciation.

. This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks. Mobileportable computers including laptop s tablets 2 years. The depreciation expense for 2019 shall be 1020.

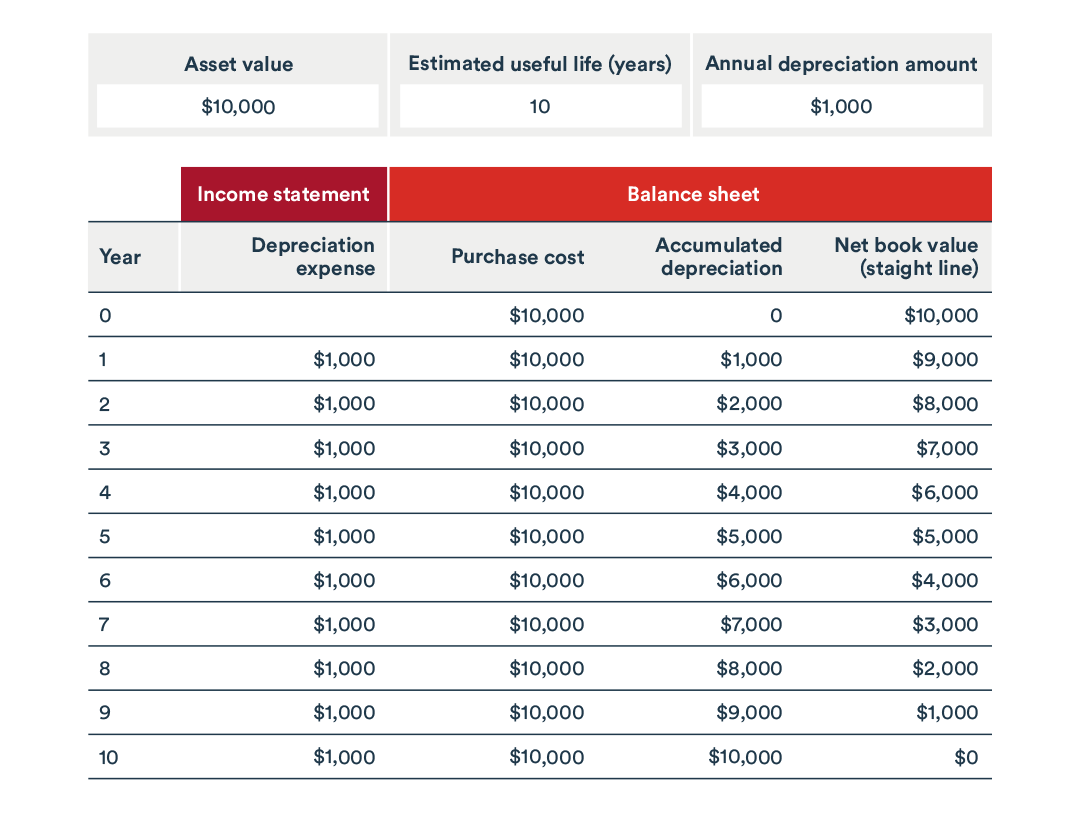

Determine the cost of the asset. Section 179 deduction dollar limits. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. SYD depreciation Method Yearly Depreciation Value remaining lifespan SYD x.

Office Equipment Depreciation Calculator The calculator should be used as a general guide only. This limit is reduced by the amount by which the cost of. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. For example if you have an asset. You probably know that the value of a vehicle drops.

Percentage Declining Balance Depreciation Calculator. There are many variables which can affect an items life expectancy that should be taken into. The calculation methods used include.

Assuming that the useful life for a laptop is three years the depreciation rate stands at 333 but not for the first and final year. The straight line calculation steps are. Also includes a specialized real estate property calculator.

You calculate the decline in value of a depreciating asset using either the. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable Computers including laptops and. While all the effort has been made to make this.

Hence the depreciation expense for 2018 was 8500-500 15 1200. Prime cost method diminishing value method You can choose whichever method you prefer however once you. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The opening NBV for 2019 would be 7300 8500 1200.

How Much Is My Laptop Worth How To Price The Old Pc

Home Office Expense Spreadsheet Spreadsheets Offered Us The Probable To Input Transform And Tax Deductions Free Business Card Templates Music Business Cards

G90spfs4trls6m

How Does Depreciation Of Assets Work For Freelancers And Consultants Tax Hacks

How To Calculate Depreciation Know Your Assets Real Value

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio

1

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Work Estimate Template For Excel Free Download In 2022 Estimate Template Templates Excel Templates

What Is Depreciation Types Examples How To Calculate Depreciation Jupiter

Calculating Cost Basis In Real Estate Quicken Loans

What Is Amortization Bdc Ca

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Surface Laptop Studio Review Redefining What A Windows Laptop Can Be Again Windows Central

How To Calculate Depreciation Legalzoom

1

3